Automated Investing: What it is and how to Take Advantage of it

Content

Automated trading systems exacerbated the crash as they saw the dropping stock price and automatically started selling extreme volumes to try and evade losses. There are additional Payment gateway risks and challenges such as system failure risks, network connectivity errors, time-lags between trade orders and execution and, most important of all, imperfect algorithms. The more complex an algorithm, the more stringent backtesting is needed before it is put into action. There are a few special classes of algorithms that attempt to identify “happenings” on the other side.

Advantages and Disadvantages of Automated Investing

- Another distinguishing factor of automated trading is its ability to remove human emotions from the trading process.

- Implementing an algorithm to identify such price differentials and placing the orders efficiently allows profitable opportunities.

- Unless the creator of the program is coaching you on how to do this or providing long-term updates and monitoring as market conditions change, it’s best to avoid getting sucked into the sales pitch.

- It uses high-speed networking and computing, along with black-box algorithms, to trade securities at very fast speeds.

- Automated trading platforms have revolutionized the way traders approach the financial markets.

- You’re quite flexible in terms of pricing, as there are multiple duration options, including 1,3,6 and 12-month long plans.

- Some platforms may require a minimum investment amount to open an account ranging from nothing to several thousand dollars.

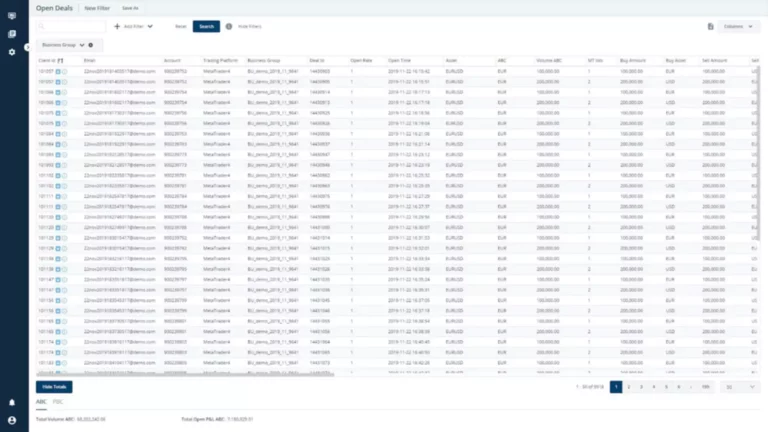

The more complex the system, the more criteria, and factors need to be considered. Autotrading is a trading plan where buy and https://www.xcritical.com/ sell orders are automatically placed based on an underlying system or program. These orders are placed when the trade conditions in the underlying system or program are met.

Advantages and Disadvantages of Algorithmic Trading

A trading plan’s a set of guidelines used by traders in decision-making and managing their trades. A trading plan should include goals and objectives, risk management strategies, entry and exit strategies, and performance metrics of a trader. This platform offers advanced charting and market analysis, as well as the ability to develop custom indicators and automated trading strategies. These fast trading platform are a set of rules and conditions that determine when and how trades will be executed.

Final Word on Using Automated Trading Software (EAs)

Many people are lured to the markets by promises of easy money via day trading robots or expert advisors (EAs). An EA, or trading robot, is an automated trading program that runs on your computer and trades for you in your account. Selling robots and EAs online has become a huge business, but before you take the plunge, there are things to consider. Automated trading systems on U.S. stock exchanges operate based on computer algorithms that analyze market data, identify trading opportunities, and execute orders at high speeds. The use of algorithms allows for rapid decision-making and execution, often in milliseconds, which is crucial in today’s fast-paced electronic trading environment. Basically, an automated system will execute trades based on the programming logic or trading strategy that has been programmed into the automated trading system.

Understanding Algorithmic Trading

In such circumstances, human discretion and judgment can occasionally be helpful. You can also build a fully personalised strategy based on your risk tolerance and goals. Algobot builds on Forex by providing this platform with better and more enhanced differentials and tools.

Moreover, robots monitor the market and help beginners enter positions at best possible time. Instead of sticking to a random plan driven by emotions, you can benefit from a disciplined trading approach, which may significantly affect your profit consistency. Automated trading bots can solve this issue, as you can get more productive by doing other things while your bot does profit-oriented trading for you.

To effectively create and maintain an EA, a trader needs both trading and programming knowledge. It needs to be routinely checked, and manual intervention may be required when random events occur or market conditions change. Automated investing represents a major shift in the investment landscape, offering a blend of efficiency, accessibility, and customization. Automated trading systems allow traders to try algorithms against previous market activity to help devise rules, which will generate profit in a procedure called backtesting.

It enforces discipline at all times, which is especially key in times of volatility. This results from the trading plan precisely being followed, and there won’t be any opportunity to hold a trade a little longer to try and squeeze more profits or sell early to avoid losses. A flash crash results from a rapid sell-off inf the stock market, subsequently declining the stock price over just a few minutes.

Consequently, you should consider the information in light of your objectives, financial situation and needs. Security is a type of financial instrument that holds value and can be traded… Gordon Scott has been an active investor and technical analyst or 20+ years. A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success. To save even more, you can refer friends and get an additional 25% off the price, resulting in a 50% discount for year-round support & powerful features.

It also features an arbitrage bot for exploiting price differences across exchanges. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets.

Interactive Brokers doesn’t impose a minimum specifically for automation, but you must ensure your account meets their general funding requirements. It takes a lot of knowledge to be able to maintain an EA, and trading skills/psychological skills are still required to intervene when necessary, but not too much. In addition to that, it can be used to trade commodities such as gold, oil, and copper, using strategies such as trend-following, mean-reversion, and statistical arbitrage. The information on this website is prepared without considering your objectives, financial situation or needs.

With autotrading, human emotions like fear, greed, or reluctance are eliminated. Meanwhile, algorithms function according to set rules, enabling controlled and consistent trading without giving in to emotional biases. Institutional investors and technical traders will use complex systems that allow for conditional orders and strategies such as grid trading, trend trading, scalping, or fading.

Focus on understanding the mechanics of algorithm development and backtesting before diving into complex strategies. With automated trading, you can backtest strategies using historical data to assess how they would have performed in the past. This allows traders to refine and optimize their strategies before committing real capital. Once these conditions are met, the algorithm automatically executes one or more trades until its goal is reached. Common types of trading algorithms include execution algorithms, profit-seeking algorithms, black-box algorithms and open-source algorithms. Automated trading systems can take into account anything from technical analysis to very advanced mathematical and statistical calculations.

Institutional investors may use complex algorithms that seek to place trades for investment portfolios based on defined criteria governed by a portfolio’s objective. This may include buying or selling securities automatically to maintain a specific percentage or dollar allocation to each stock, or matching the holdings in the portfolio to an index. Brokerage platforms such as Interactive Brokers, for example, offer coding and autotrading capabilities. Institutional investors will typically have their proprietary trading platforms that allow for autotrading through algorithmic programming.

David Stewart

I'm David Witherington Stewart, a Florida-based author with a background in physics, aerospace, and software development. My works, including Angel of Mortality, blend science fiction with intricate themes. I draw inspiration from my 40-year aerospace career and personal experiences.

Creating Technology For Good: The Yin and Yang of AI

Photo by Planet Volumes on Unsplash Understanding how to use technology to improve the lives of others instead of sel...

How Technology Will Change The World: Future Is Technology

We can cite instances throughout history where technology has improved opportunities by producing better goods and se...

What are the Dangers of Abusing Technology: First Seen in Novels

Photo by SCARECROW artworks on Unsplash The myriad positive effects of technology have undoubtedly made life easier f...

AI and Morality: A Dilemma and the Ongoing Struggle

Photo by Alex Knight on Unsplash The ability of a computer or computer-controlled robot to carry out actions typicall...

The Dangers of AI in Criminal Activity: Into the Dark Side

Photo by Towfiqu barbhuiya on Unsplash Artificial Intelligence (AI) provides promising capacities, especially in its ...

Battle Against Criminal Syndicates: AI’s Crime Fight

AI robot connecting dots, depicting AI’s battle against criminal syndicates | Photo by Tara Winstead Today̵...

The Xenoborg Threat: David W. Stewart’s Angel of Mortality

Photo by Jens Mahnke David W. Stewart’s Angel of Mortality is a futuristic novel about saving Earth from the xe...

Chronicles of Tomorrow: Humanity’s Fight With Innovation

Photo by Alex Knight In a world full of constant changes especially with regards to progress in technology, “An...

Syndicates in Society and Its Far-Reaching Impact

A woman tied in the dark | Photo by James Kovin on Unsplash What are the effects of syndicates in society? Syndicates...

Battle Against Global Criminal Syndicates: Ways of Stopping Them

Global criminal syndicates are significant drivers of conflict. They cause violence, pain, and injustice, especially ...

Creating Eve’s Conscience

In Angel of Mortality, Raisa faced the challenge of giving the character EVE a moral compass to make logical decision...

It’s Time to Embrace Changes That Lead to a Better Life

Photo by Pavel Danilyuk They say that the only constant in this world is change, and although that statement is quite...

0 Comments